Which Investment Platform Should I Be Using?

Here, I give an honest lowdown on a handful of retail platforms I've used to invest and execute trades

I started investing in 2013, as soon as my student maintenance grant dropped. I made many mistakes but also got super lucky too. Choosing a platform to invest from was easy, I copied my friends. Most had been gifted ISAs from their parents (something I wish to emulate) and as such, it was a no brainer. Over the years though, as I have matured within the field of finance and gained experience using a number of platforms personally, I have noticed some stark and some subtle, but powerful differences across the spectrum.

I will go through the platforms I use, one by one and pick out my major highlights. Some are good, some aren’t so good, but I’ll let you decide which you will add to your investing armoury.

Hargreaves Lansdown

BROAD ACCESS to stocks and funds globally

For me, this is the stand out benefit of using HL. It provides extensive access to a plethora of stocks & funds globally which users can deploy investments into. This may sound like a small feat but not every platform offers that and believe me, it’s very important. Imagine doing your homework, finding a company which you wanted to invest in, then BOOM! Plans shattered, all because your investment platform doesn’t provide access to the company’s stock - what a shame.

The mechanics of the stock market, especially in countries where market structure is not super developed and in stocks where execution routes are less available means that unless a platform has access to liquidity (capability to buy/sell), it won’t be able to facilitate your investment intentions.

On top of this, providing access to hard-to-reach areas of the stock market (often reserved for institutional investors) through funds helps you be that little bit more dynamic when constructing your portfolio (or choosing an investment vehicle to do it for you). Case in point, if you wanted exposure to Vietnamese stocks, where would you go? Hargreaves Lansdown my friend. That leads me nicely onto my second point.

CUSTOM PORTFOLIO access to assets beyond stocks

HL allows you to go beyond just picking stocks and gives you the elementary tools needed to construct your own portfolio if you know how to or a route in to the professionals that can do it for you. One of these tools is access to asset classes beyond stocks, most notably bonds. Not everyone wants to put all their cash into stocks, you may want some exposure to investment grade bonds (corporate and country debt which is considered quality) or high yield bonds (debt considered higher risk but also yields a higher return). Most retail investment platforms do not offer bond investing capabilities.

In addition, there are basic portfolio analytics tools provided which allow you to understand more about the risk profile of your investments and therefore customise your holdings to be closer aligned to your goals. I guarantee you will interpret the news completely differently when you understand what your money is actually exposed to. Nevertheless, this is a basic requirement of anyone planning to customise their portfolios and keep track of their consequent risk profile.

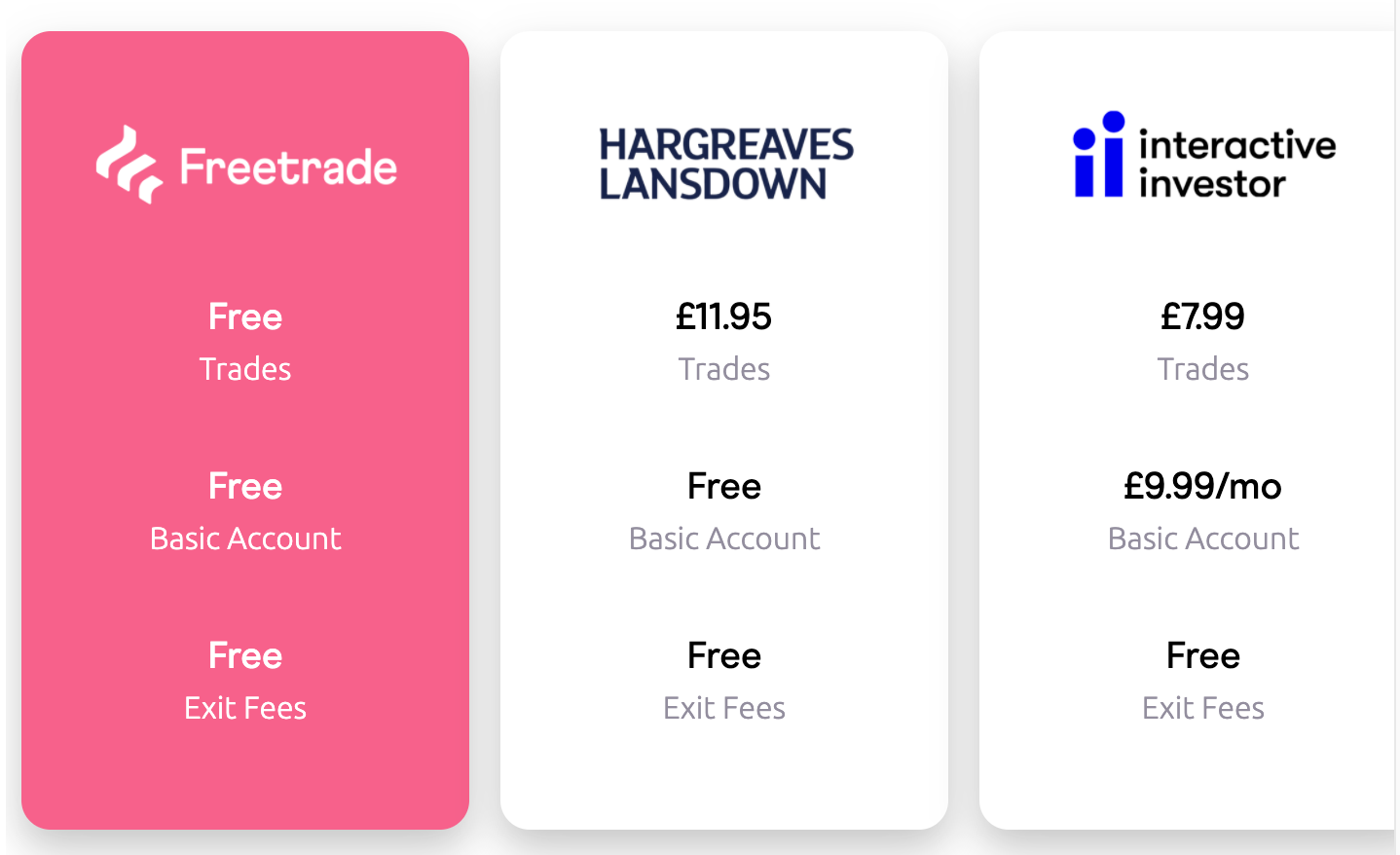

EXPENSIVE FEES lots of platform benefits but it costs!

One thing I have learned during my career within financial markets is that if something is good, it doesn’t come cheap - and if it isn’t good, it’s inefficient - and if it’s neither of those things then it commands a certain price solely because people are willing to pay for it! HL is by no measurement inefficient, nor is it immune to competition from fee-free platforms. What it has in abundance, is access to investment capabilities its peers simply do not have. So until the competition catches up, they can make us pay up for the pleasure of using their platform.

Below are the costs of dealing in stocks. As you can see, if you wanted to buy £1000 worth of stock, it would cost 1.195% initially and another 1.195% when you decide to sell it. So HL clearly isn’t a trader friendly platform. And even if you are an investor, you have to be dealing above a certain size otherwise it will not make economic sense to deal. For instance: your investment idea has a potential to make 10% and you have £100. It will cost £11.95 * 2 to buy and sell the stock i.e. more than 20% immediately rendering the whole thing pointless.

No doubt, only certain retail investors are genuinely savvy and interested enough to invest beyond heavily marketed hot stocks such as Tesla right now. So limited market access might not matter. Therefore the potentially high cost of dealing may not impact everyone, but if your investment deployments are not beyond a certain size, execution costs can simply eat away at your gains. You will be pleased to know, there are no fees to execute on funds, but be aware of the ongoing costs of owning funds, typically up to and around 1.5%

Freetrade

FREE from commission (other trading costs are baked into execution price)

The standout benefit of Freetrade is in the name really, it provides commission fee-free execution. In other words, you will not be charged for buying and selling stocks & ETFs. What this means is for trading in and out of stocks (if that’s your thing) this platform trumps all its UK originated counterparts, you might get your trades wrong but you won’t be charged for doing so. It doubles up well as an investment platform too. But beware, if you use its ISA wrapper, you will be charged £3 a month for the pleasure. So the smaller your portfolio the bigger the cost. More serious traders and investors may look to evaluate the trading costs baked into execution prices.

EASY to use

Simplicity is key and can be a powerful distinguishing factor between investment platforms. A complex platform can lead to misunderstandings and when it comes to executing trades or investment decisions, mistakes cost money. It may sound super simple but even professionals sometimes hit the buy button instead of sell, or select the wrong price limits or any other fiddly typos that arise from simple but intricate decisions. As a result, a clear and simple user experience helps to minimise the risk of losing money for no good reason.

The other avenue where simplicity manifests as an absolute winner is navigation. As a mobile app-first platform, Freetrade is smooth at the fingertips. From topping up and searching for stocks & ETFs to deploying trades & investments and checking ISA performance, all it takes is a few taps. This is super useful if you need to check things on a fly. Other platforms are similar, but Freetrade’s design is definitely up there, eclipsing the likes of Nutmeg’s mobile app.

LACKS BROAD ACCESS to stocks & ETFs domestically and globally

Realistically, although Freetrade is a great platform with a fantastic mission (honestly, I invested in Freetrade privately to support its development) it is a fairly new company. The downside to being a newbie in this business is that you won’t have the extensive reach some of the more mature broker platforms do in the the early days. With that said, expansion is fully in gear and over the near term you will see rapid improvements as I have over the last few months.

Nutmeg

LONG TERM by nature, sign up here

Nutmeg is most definitely geared towards the long term investor. If you are investing in stocks and shares ISAs, LISAs or any vehicles of that nature, Nutmeg should definitely be high up on your list of preferred platforms. It works on the basis of 10 different risk portfolios, with equivalent ESG tilts. So you choose your risk appetite, your starting capital, time period - as all serious long term investors are accustom to - and the amount you wish to contribute monthly. From there, Nutmeg uses those parameters to model what your portfolio might look like at the end of your target time horizon. These are not guarantees but such exercises allow you to think about your financial situation on a forward basis and evaluate potential scenarios.

Here is the track record for one of Nutmeg's portfolios. Given my age, this is the one I have been invested in since I opened up an ISA on the platform.

Once you have deployed your cash into investments, the performance evaluation is quite dynamic too. Returns can be viewed on an absolute basis as well as a time-weighted basis. This means you can seen how your portfolio has changed between two time periods in terms of purely investment gains but also accounting for the fact that you may have gained a lot on your initial contribution and less on your most recent contribution.

TIME LAG between investment decisions and deployments

I’m an avid user of Nutmeg but I have to say, this is probably the most annoying thing about it. Due to the long term nature of the portfolios it manages, there are only two days in the week when trading and rebalancing takes place. What this means in practice is that if you decide to make an investment deployment or withdrawal, you may not be able to do so instantly. Your instruction will be logged and executed within the next trading cycle. This could be a couple of days later and in reality, markets can move a whole lot in that period.

Although a clear drawback if you are looking to slide in and out of positions regularly, this systematic approach of trading on specific days is very much in line with long term investing behaviour. By doing so, trading costs can be minimised and as such overall investment fees kept low. Over a long period, small fee savings are actually super impactful and your pockets will thank you greatly.

AUTOMATIC CONTRIBUTIONS

Nutmeg is really built for the long term passive investor. I use it for my monthly non-pension investment contributions through direct debit on payday. It’s great because I don’t have to bother logging into the website, ever. That’s a personal decision though, I set out a long term goal so don’t need or want to see the short term noise - I use other platforms for short term plays. This low touch low maintenance approach means I can focus on other areas of my wider portfolio that require more hands on management.

If at any point your investment appetite changes due to a change in personal financial situation, you can always tinker with the risk parameters within the Nutmeg platform and switch into holdings which better reflect your situation. Your automatic contributions will adjust thereafter so no need to worry about adding to your old portfolio by accident. I find this platform perfect for long term ISAs that you don’t intend on drawing down from any time soon, we’re talking 5/10/15/20 years. If I had a child, I’d definitely be using it for their investment ISAs too before handing over when they turn 18 years old.

Choosing the right investment platform depends on a few major factors:

what exposures you want to access

your time horizon

the size & frequency of your trades/investments

As you have read in this blog, I mainly use three platforms (there are tons!) for different parts of my overall portfolio for entirely different reasons. Hopefully this provides some food for thought when analysing your own landscape. Open up the discussion further with questions or let me know what platforms you find to work best and why.

Until next time ✌🏾

Ive heard alot about vanguard - this wasn't included in your assessment just wondering your thoughts?